7 tips to help you gain financial stability

Summary

The quest for economic growth and financial stability is perhaps one of the biggest driving forces behind every individual’s major life choices. The way you handle your finances not only impacts the quality of your life, but also plays a major role in your ability to achieve whatever goals or objectives you have set.

Following these 7 tips can help you take control of your financial life.

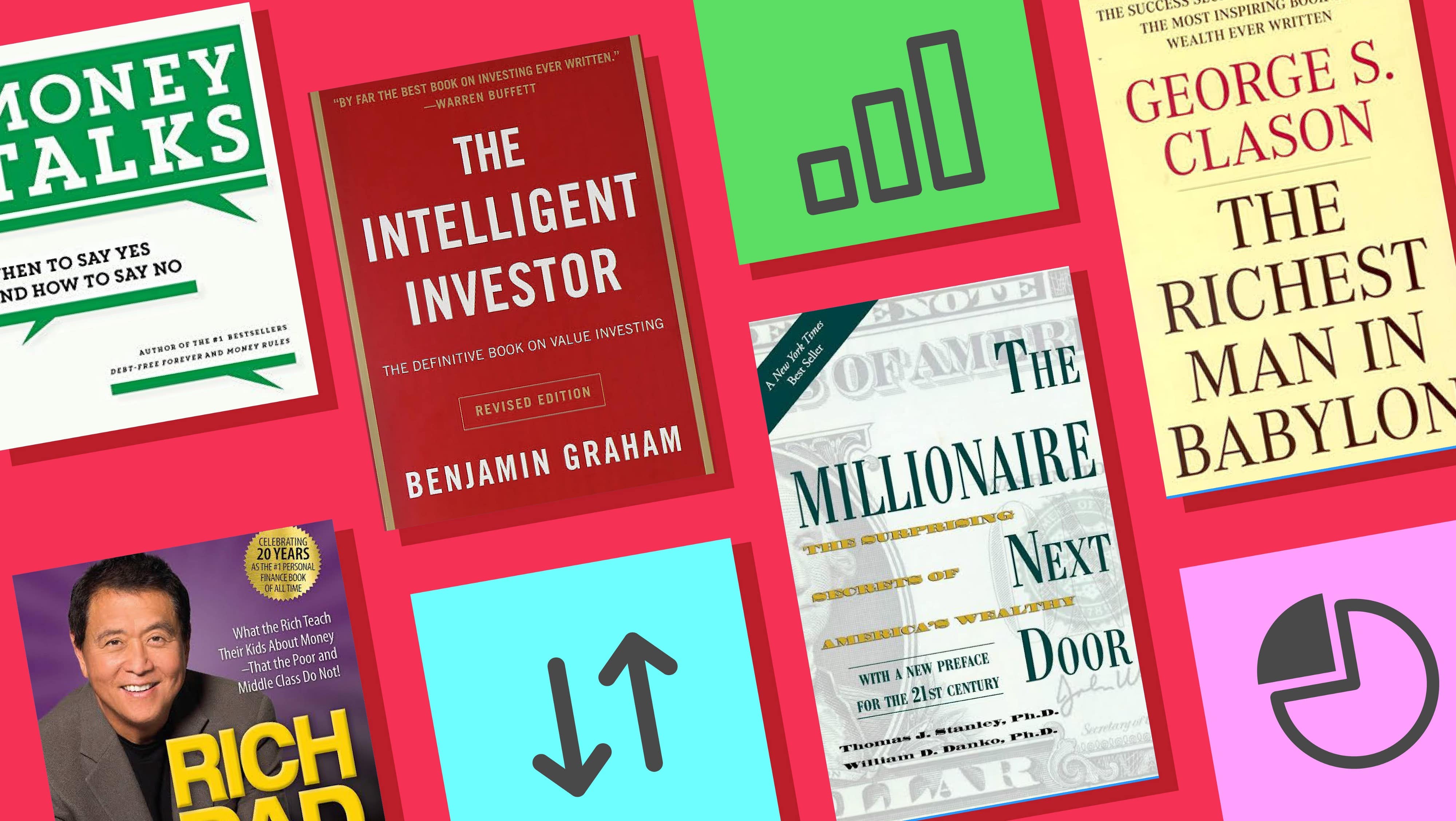

Read personal finance books

Reading is a great way to acquire knowledge on any subject, with personal finance being no exception. With so many written materials by financial experts available, it is certainly a good idea to get your hands on a few in order to gain extra financial wisdom and broaden your scope on how to deal with your finances.

Read How to promote a business in Ghana

Make a budget

Budgets are very necessary if you intend to get a better understanding of your finances and how to manage them. Start by writing down your monthly income, then make a scale of preference list of all the expenses you intend to make within the month. Calculate your expenses and compare them to your income. If your expenses are over your income, then you need to find a way to get them down.

You can start by cutting out the things on your expense list you know you can do without. Sticking to a budget takes real discipline and dedication, so try your possible best to live within the budget you created.

Reduce the number of times you eat out

Reducing or even putting a stop to eating out if possible is a proven method of saving money. Cooking at home is much more economical when compared to eating at restaurants, especially if you cook in bulk and store them.

Sending home cooked meals to work instead of going out for lunch each day will help you save so much money. Money that can then be directed into another area.

Read 9 practical ways to help you stop procrastinating

Start saving

This might be an obvious tip but it is very important. Saving not only helps you get something down for future investments, it also serves as a backup for you in case of any emergency. Set aside a percentage of your income every month and deposit it into a savings account, preferably a separate account from your main account so you are not tempted to touch it whenever you are making personal withdrawals.

Once again, doing this requires a lot of discipline so you must make the conscious effort to see this through.

Get an extra source of income

Having only one source of income is not an ideal situation in the current financial climate. Getting an extra or if possible multiple sources of income will help increase your chances of being financially stable. Look around you for any business opportunity you can take advantage of so you can earn extra cash.

Read 6 creative ways to have fun with friends while on a budget in Ghana

Improve your skill set

Whatever your field of work is, it is very crucial you constantly improve your level of skill so as to make you a valuable asset to your employer or customers. This will have a direct impact on your finances as you are more likely to earn more as a result of your excellent performance.

Have a well-thought-out long-term investment plan

Having a long-term investment plan will not only help secure your future, but it will also help you stay focused and motivated. Whether your goal is to build a house or set up a company, it is very necessary that you come up with a step-by-step plan including a timeline on how you plan to make your dreams a reality.

Once you focus your energy into making sure your target is achieved, you automatically enhance your chances of being financially stable.

Comments